Overview of Spaghetti Models

![]()

Spaghetti models are a type of financial modeling technique that involves creating multiple scenarios to forecast the future performance of an investment or financial instrument. Each scenario is represented by a different line on a graph, resembling a plate of spaghetti, hence the name “spaghetti models”.

Spaghetti models are used to account for the uncertainty and variability inherent in financial markets. By generating multiple scenarios, analysts can assess the potential range of outcomes and make more informed decisions.

Benefits of Spaghetti Models

- Comprehensive analysis: Spaghetti models provide a comprehensive view of potential outcomes, helping analysts identify both upside and downside risks.

- Stress testing: They can be used to stress test investments or portfolios, assessing their resilience under different economic conditions.

- Risk management: Spaghetti models aid in risk management by quantifying the potential impact of various scenarios on investments.

Limitations of Spaghetti Models

- Data dependency: The accuracy of spaghetti models relies heavily on the quality and completeness of the input data.

- Complexity: Creating and interpreting spaghetti models can be complex and time-consuming.

- Subjectivity: The selection of scenarios and assumptions used in spaghetti models can be subjective, influencing the results.

Industries Where Spaghetti Models Are Used

- Banking: Assessing credit risk, loan performance, and investment portfolios.

- Insurance: Forecasting claims frequency and severity, pricing insurance products.

- Investment management: Evaluating investment strategies, asset allocation, and risk management.

Applications of Spaghetti Models

Spaghetti models, with their ability to generate numerous scenarios, find diverse applications in financial forecasting, risk management, and portfolio optimization.

In financial performance forecasting, spaghetti models can simulate a wide range of potential outcomes, providing a comprehensive view of possible future scenarios. This enables businesses to make informed decisions and develop contingency plans to mitigate potential risks.

Role in Risk Management and Decision-Making

Spaghetti models play a crucial role in risk management by quantifying and assessing potential risks. By simulating various scenarios, businesses can identify and prioritize risks, enabling them to develop effective mitigation strategies. Additionally, spaghetti models can assist in decision-making by providing a comprehensive understanding of the potential consequences of different decisions.

Use in Portfolio Optimization and Asset Allocation

Spaghetti models are valuable tools for portfolio optimization and asset allocation. They can simulate different investment strategies and market conditions, allowing investors to identify optimal asset combinations that meet their risk-return objectives. By analyzing the spaghetti plots, investors can make informed decisions about portfolio diversification and asset allocation, maximizing returns while minimizing risks.

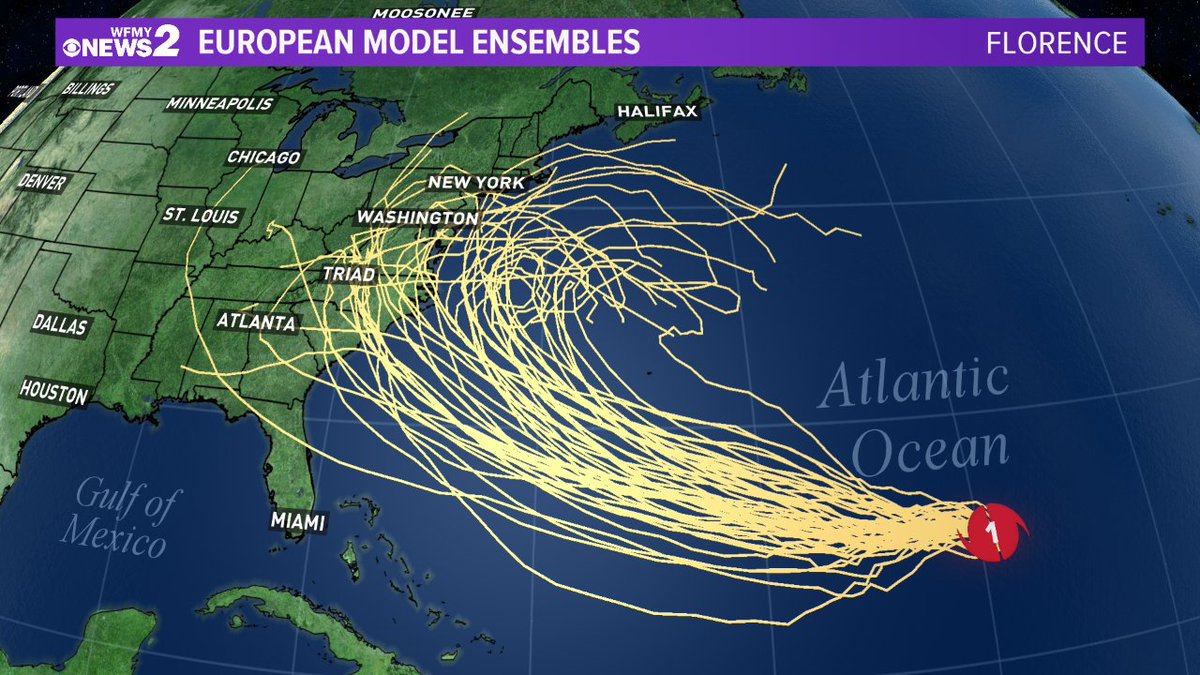

Spaghetti models are a fun way to explore different possibilities. They can help us understand the potential paths of a storm, like the beryl projected path. By looking at the spaghetti models, we can get a better idea of where the storm might go and how strong it might be.

This information can help us make informed decisions about how to prepare for the storm.